If you are coming to work in Ireland, your residency determines your tax status. Here we provide a summary of Ireland’s residency rules and tax implications.

If you are present in Ireland for 183 days in one year or 280 days over two consecutive tax years you will be regarded as tax resident in Ireland. If you have been tax resident in Ireland for the previous three consecutive tax years, you will be ordinarily resident for the fourth year.

Domicile status is also used as a general concept when determining a person’s exposure to tax. Your domicile is the origin of birth, acquired primarily from an individual’s father. It is mainly relevant for the treatment of certain foreign income for an individual who is resident but not domiciled in Ireland.

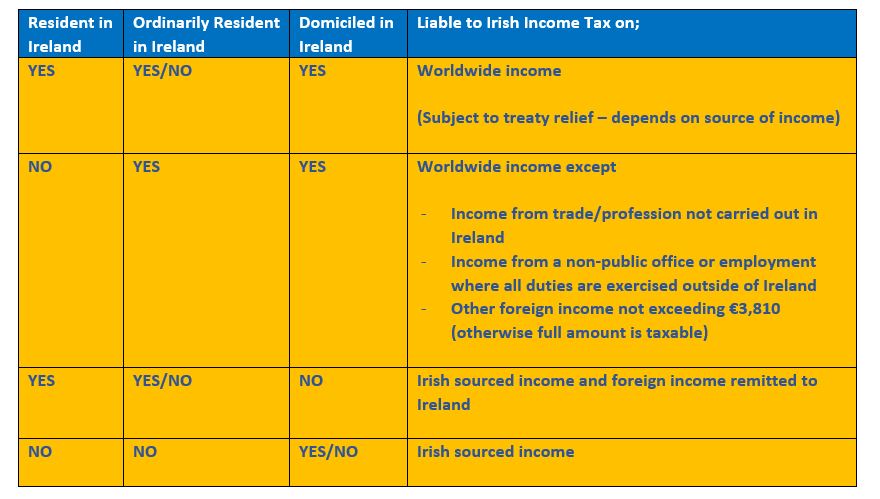

Based on a person’s domicile and residency status, below is a summary of the tax implications this may entail;

Please note this article is for information purposes and does not constitute advice. Details correct at time of publishing.